Consumer investing – spending pattern strategies

Allocating capital between discretionary and staples sectors requires precise timing aligned with the economic cycle. During expansion phases, consumer demand for non-essential goods typically surges, favoring exposure to luxury brands, entertainment, and travel-related equities. Conversely, defensive positioning in essential goods companies offers resilience when downturns suppress overall consumption. This cyclical rotation enhances portfolio robustness against macroeconomic volatility.

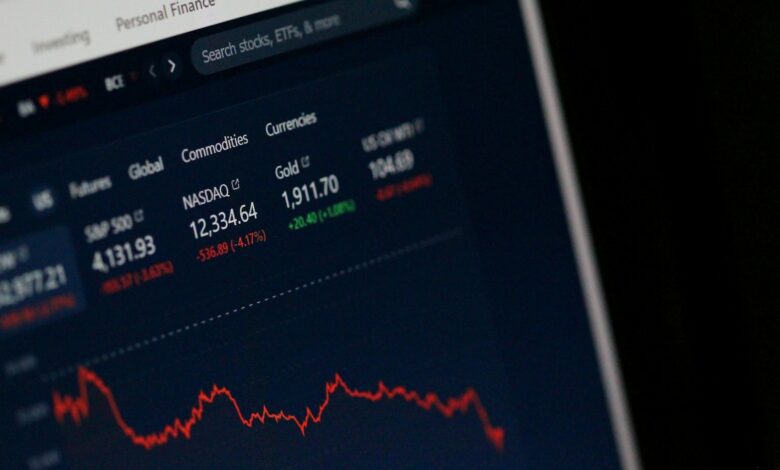

Analyzing expenditure trends reveals actionable insights into market sentiment shifts. For instance, rising consumer confidence indices often correlate with increased outlays on durable goods, signaling a potential upswing in related stock performance. Incorporating real-time retail sales data and credit usage statistics refines entry points for capital deployment across diverse segments within the consumption sphere.

Diversification across subcategories mitigates risks associated with abrupt behavioral changes driven by regulatory or inflationary pressures. Balancing holdings between staples – such as food and household products – and discretionary items cushions portfolios from sudden declines in either segment. Tactical adjustments based on leading indicators like wage growth and unemployment rates support optimized allocation frameworks that adapt dynamically to evolving economic conditions.

Consumer investing: spending pattern strategies [Investment Insights investment-insights]

Allocating resources based on cyclical fluctuations in discretionary expenditures can significantly enhance portfolio resilience during varying economic phases. Data from the U.S. Bureau of Economic Analysis indicates that discretionary consumption often contracts by up to 15% during recessions, suggesting a shift toward essential goods and conservative asset allocation. Aligning capital deployment with these behavioral shifts allows for optimized exposure to sectors benefiting from either expansionary or contractionary consumer tendencies.

Analyzing expenditure trends through granular segmentation reveals distinct subcycles within broader market movements. For instance, luxury goods and non-essential services tend to experience amplified volatility corresponding to consumer confidence indices. Employing dynamic allocation models that incorporate real-time sentiment analysis and spending velocity metrics provides actionable insights into timing entry and exit points, especially in volatile environments influenced by geopolitical or regulatory changes.

Strategic Approaches Based on Economic Cycles

During expansion periods, increased disposable income drives heightened demand for non-essential products, presenting opportunities in sectors such as technology, travel, and entertainment. Quantitative studies demonstrate a positive correlation (r ≈ 0.7) between rising household discretionary expenditure and equity performance in these industries. Conversely, defensive positioning is advisable when contraction signals emerge; shifting focus toward staples and utilities can mitigate downside risk while preserving capital.

- Growth Phase: Amplify holdings in consumer cyclicals linked to enhanced purchasing power.

- Recession Phase: Rebalance towards stable income-generating assets with lower sensitivity to spending volatility.

- Recovery Phase: Gradual reintroduction of selective risk assets aligned with improving employment rates and wage growth.

The integration of blockchain analytics offers novel perspectives on spending behavior by tracking tokenized transactions across decentralized platforms. Patterns extracted from cryptocurrency wallets indicate nuanced shifts in liquidity preferences among retail investors correlating with macroeconomic indicators such as inflation rates and central bank policy adjustments. These insights enable refined forecasting models that anticipate shifts in asset demand ahead of traditional financial reporting cycles.

Differentiating between fixed and variable expenditure streams enhances precision in predicting market reactions to fiscal stimuli or monetary tightening. Empirical evidence suggests that consumers prioritize credit availability over immediate cash reserves when adjusting their consumption basket under financial stress, influencing credit-sensitive sector valuations accordingly. Portfolio managers leveraging this knowledge can calibrate exposure dynamically, reducing drawdowns linked to sudden changes in borrowing costs or lending standards.

A comprehensive understanding of consumer finance dynamics combined with technological advancements provides a robust framework for optimizing capital allocation throughout economic cycles. Incorporating multi-source data streams–including blockchain transaction volumes, credit card usage statistics, and macroeconomic indicators–enables sophisticated scenario planning that anticipates shifts before they manifest broadly in markets. This methodology equips investors with an adaptive toolkit designed for the complexities of contemporary financial ecosystems.

Analyzing Consumer Spending Behavior

Optimizing asset allocation requires a thorough understanding of expenditure trends within the discretionary segments, which often dictate the flow of capital through economic cycles. Recent data from the U.S. Bureau of Economic Analysis indicates that non-essential outlays constitute nearly 30% of total personal consumption expenditures, underscoring their influence on market liquidity and investment opportunities.

Evaluating expenditure rhythms over multiple quarters reveals cyclical fluctuations tied to macroeconomic indicators such as employment rates and inflation metrics. For instance, during periods of tightening monetary policy, there is a marked contraction in discretionary disbursements, directly affecting asset classes reliant on consumer confidence and cash flow velocity.

Segmenting Financial Allocation Patterns for Enhanced Forecasting

Analyzing transactional datasets reveals distinct clusters of financial behavior that correlate strongly with demographic variables and technological adoption levels. A study by McKinsey highlights that younger cohorts demonstrate higher volatility in expenditure choices, favoring digital assets and novel financial instruments over traditional holdings. This shift necessitates adaptive portfolio management approaches that integrate real-time analytics with behavioral finance insights.

A comparative analysis between cyclical spending and investment inflows highlights the importance of timing within economic expansions and contractions. Data from the Federal Reserve’s Flow of Funds report illustrates how shifts in disposable income allocation impact capital markets, particularly sectors sensitive to consumer sentiment such as retail equities and blockchain-based ventures.

Implementing predictive models based on historical consumption data enhances strategic decision-making frameworks by identifying leading indicators of market transitions. For example, tracking changes in luxury goods purchases can serve as an early warning signal for broader economic slowdowns or recoveries, allowing investors to recalibrate risk exposure accordingly.

The regulatory environment also plays a pivotal role in shaping expenditure dynamics by influencing liquidity and credit availability. Recent amendments to financial compliance standards have affected borrowing costs, thereby modulating discretionary fund access and altering capital deployment strategies across different asset classes including cryptocurrencies.

Aligning Investments with Cash Flow

Effective allocation of capital requires synchronizing portfolio decisions with the inflow and outflow of funds throughout an economic cycle. Prioritizing investments in non-discretionary sectors, such as staples, can provide stability when liquidity constraints tighten, whereas allocating assets toward cyclical industries may capitalize on periods of surplus cash availability. Analyzing recurring revenue streams alongside expenditure commitments enables more precise timing of asset purchases or divestments, minimizing forced liquidations during downturns.

Examining expenditure trends reveals that essential goods maintain consistent demand regardless of economic fluctuations, offering defensive positioning for capital deployment. Conversely, discretionary segments experience pronounced volatility in correlation with consumer confidence and income variability. Incorporating these behavioral insights into fiscal management supports dynamic rebalancing tailored to cash flow patterns, preserving portfolio resilience while optimizing growth potential.

Integrating Financial Flows within Market Cycles

Cash flow alignment benefits from granular monitoring of inflows relative to scheduled obligations, enabling strategic layering of equity and fixed-income instruments that mirror anticipated liquidity windows. For instance, during expansion phases characterized by increased disposable income, reallocating towards higher-beta assets aligns with amplified risk appetite and enhanced capital availability. In contractionary stages, shifting exposure toward dividend-yielding staples or government securities mitigates downside risks posed by reduced spending capacity.

Case studies from recent market cycles illustrate the efficacy of this approach: investors who adjusted holdings based on quarterly earnings cadence and consumer expenditure data realized superior drawdown control and capture ratios compared to static allocations. Moreover, regulatory shifts affecting monetary policy can alter cash flow dynamics through interest rate adjustments or liquidity provisions; proactively incorporating these variables refines investment timing within complex financial ecosystems.

Adjusting Portfolios for Spending Shifts

Active reallocation within a portfolio is advisable when shifts in consumer expenditure emerge, particularly between essential goods and non-essential categories. Data from multiple economic cycles indicate that during downturns, assets linked to staples tend to outperform those tied to discretionary items due to stable demand. Consequently, increasing exposure to sectors aligned with fundamental needs can mitigate downside risks and preserve capital through varying phases of the economic cycle.

Conversely, periods characterized by rising disposable income often favor allocations toward luxury and discretionary sectors. Analytical models correlating consumer behavior indices with asset returns demonstrate that portfolios weighted towards these segments can capitalize on expanding market opportunities. A balanced approach involves dynamically adjusting holdings based on validated indicators reflecting changes in consumption trends and macroeconomic signals.

Sector Rotation Based on Consumption Trends

Implementing rotational tactics rooted in observed alterations of purchasing habits enhances portfolio resilience. For example, during inflationary episodes, price sensitivity typically increases among consumers, leading to reduced spending on non-essentials while maintaining or boosting purchases of necessities. Historical case studies from the 2008 financial crisis show that reallocating assets from cyclicals to defensive equities preserved portfolio value effectively.

Integrating alternative asset classes such as cryptocurrencies requires nuanced understanding of their correlation with traditional spending cycles. While digital assets have shown low correlation with staples and discretionary stocks historically, recent volatility patterns suggest potential reactivity to broad market sentiment shifts influenced by consumer confidence metrics. Thus, incorporating blockchain-based investments demands vigilant monitoring of macro-financial indicators aligned with consumer expenditure dynamics.

Quantitative analysis tools leveraging real-time transaction data offer granular insights into evolving consumption behaviors, enabling precise recalibration of investment allocations. Employing machine learning algorithms on retail sales figures and payment data streams can predict transition points between spending categories, allowing portfolio managers to adjust weights proactively rather than reactively.

The cyclical nature of consumption necessitates continuous reevaluation of portfolio composition. Investors should consider not only immediate shifts but also anticipate longer-term transitions driven by demographic changes or technological adoption affecting expenditure types. Strategic deployment of capital across sectors sensitive to these variables supports sustainable growth and risk mitigation over successive economic phases.

A comprehensive approach integrates financial innovation alongside traditional asset classes by leveraging blockchain analytics and decentralized finance instruments responsive to consumer behavior trends. This methodology enhances portfolio adaptability amid complex market environments where conventional patterns may be disrupted or accelerated due to regulatory changes or global economic fluctuations.

Tracking Returns from Spending-Based Investments: Analytical Conclusions

Prioritizing allocations between discretionary and staples sectors remains pivotal for optimizing returns linked to consumption-driven asset exposures. Empirical data from recent economic cycles illustrate that portfolios overweight in non-essential goods often outperform during expansionary phases, while staples exhibit resilience amid downturns, underscoring the necessity of dynamic allocation frameworks based on evolving expenditure trends.

Advanced quantitative models leveraging real-time transactional datasets now enable granular segmentation of consumer behavior, enhancing predictive accuracy for market movements tied to consumption flows. Integrating blockchain-verified spending records with macroeconomic indicators offers unprecedented transparency and robustness in forecasting investment outcomes driven by end-user demand shifts.

Key Technical Insights and Future Implications

- Behavioral segmentation: Differentiating discretionary versus essential goods consumption patterns facilitates targeted exposure adjustments, improving risk-adjusted performance metrics across economic cycles.

- Algorithmic adaptation: Machine learning algorithms calibrated on heterogeneous spending signals can dynamically reweight portfolio components, aligning asset allocations with emergent consumer expenditure tendencies.

- Regulatory environment: Upcoming data privacy regulations will shape access to granular spending analytics; proactive compliance integrated with blockchain immutability ensures secure yet actionable insight extraction.

- Evolving monetary policies: Inflationary pressures shift purchasing priorities toward staples, requiring adaptive hedging mechanisms within asset mixes sensitive to consumer cost-of-living adjustments.

The intersection of precise consumption metrics and decentralized ledger technology paves the way for a new paradigm in capital deployment strategies anchored in real-world economic activity. Anticipated advancements include tokenized indices reflecting discrete categories of consumer expenditures, enabling fractionalized participation and enhanced liquidity aligned with actual fiscal flow dynamics.

A nuanced understanding of expenditure fluctuations–distinguishing between essential outlays and luxury purchases–will increasingly define competitive advantage among wealth allocators. Forward-looking portfolios must incorporate multidimensional data inputs spanning transactional velocity, sectoral inflation impacts, and sentiment analysis derived from blockchain-validated consumer interactions.