Economic indicators – market-moving data analysis

Focus on leading measures such as GDP growth rates and employment figures to anticipate shifts in asset prices. Quarterly GDP expansions above 3% historically correlate with bullish equity performance, while non-farm payroll gains exceeding 200,000 often signal stronger consumer demand and increased risk appetite.

Monitor inflation trends alongside labor market conditions to evaluate central bank policy direction. A tightening job market paired with rising wage growth tends to accelerate interest rate adjustments, which directly impact bond yields and currency valuations. Early recognition of these patterns enables strategic positioning ahead of market reactions.

Incorporate high-frequency releases like manufacturing PMI and retail sales into your decision-making framework for real-time insight on economic momentum. Divergences between these proxies and headline GDP can reveal underlying strength or vulnerabilities, providing a competitive edge in timing portfolio reallocations.

Economic indicators: market-moving data analysis [Investment Insights investment-insights]

Monitoring employment figures provides critical foresight into broader economic trajectories, directly influencing asset valuations within cryptocurrency markets. For instance, a consistent rise in nonfarm payrolls typically signals strengthening labor conditions, which can lead to increased consumer spending and heightened demand for risk assets, including digital currencies.

Gross Domestic Product (GDP) growth rates remain among the most comprehensive measures of national performance. Quarterly GDP expansions above consensus forecasts often coincide with bullish sentiment across various financial instruments. Conversely, contractions or revisions downward may trigger caution among investors, prompting portfolio reallocations toward safer holdings.

Leading Measures and Inflation Dynamics

Leading benchmarks such as manufacturing orders and consumer confidence indexes offer anticipatory insight into upcoming market movements. These proxies frequently precede shifts in capital flows by several weeks, enabling traders to position themselves advantageously ahead of official releases. For example, a surge in durable goods orders has historically correlated with subsequent rallies in blockchain-related equities.

Inflation readings substantially affect monetary policy expectations and consequently asset pricing models. The Consumer Price Index (CPI) and Producer Price Index (PPI) inform central bank decisions regarding interest rate adjustments. Elevated inflation pressures may prompt tightening cycles that reduce liquidity availability, often causing temporary pullbacks in cryptocurrency valuations sensitive to risk sentiment.

- Employment reports: Provide near-real-time snapshots of labor market health.

- GDP statistics: Capture overall economic momentum with high relevance for investment horizons.

- Leading indicators: Forecast trends before mainstream recognition.

- Inflation metrics: Guide expectations on monetary stance shifts impacting asset classes globally.

The interplay between these metrics demands rigorous scrutiny when forecasting price dynamics within crypto ecosystems. Investors should integrate cross-referenced information streams rather than rely on isolated releases to anticipate potential corrections or accelerations effectively. Case studies from past economic cycles reveal that misinterpretation or delayed reactions to such figures have resulted in missed opportunities or amplified drawdowns among digital asset portfolios.

An informed approach incorporates not only primary statistics but also contextualizes them within regulatory developments and macro-financial trends. As global monetary frameworks evolve alongside technological innovation in finance, understanding how shifts in labor markets or inflationary trends propagate through decentralized systems becomes increasingly indispensable for sophisticated asset allocation strategies.

Interpreting GDP Growth Trends

Accurate interpretation of GDP growth trends requires focusing on the interplay between output expansion and inflationary pressures. A rising GDP accompanied by moderate inflation typically signals sustainable development, whereas high inflation alongside GDP growth may indicate overheating or asset bubbles. Monitoring these dynamics allows investors to anticipate shifts in fiscal and monetary policy, which directly influence financial markets and capital allocation strategies.

Leading metrics such as manufacturing orders, consumer spending patterns, and employment figures provide early signals of GDP trajectory changes. For instance, a consistent uptick in industrial production often precedes reported increases in national output by several quarters. Incorporating these precursors into forecasting models enhances precision when assessing economic momentum and potential inflection points.

GDP Components and Their Market Implications

The composition of GDP growth–consumption, investment, government expenditure, and net exports–offers granular insight into underlying drivers. Consumption-led expansions suggest robust domestic demand but may raise concerns about rising household debt levels if credit growth outpaces income gains. Conversely, investment-driven growth can signal future productivity improvements but might also reflect speculative behavior if capital flows disproportionately to volatile sectors like technology or real estate.

Examining cross-country case studies illustrates varied responses to similar GDP growth rates. For example, Japan’s prolonged recovery period after the 1990s asset bubble contrasted with Germany’s export-driven rebound post-2008 crisis demonstrates how structural factors condition market reactions. Understanding such nuances aids in contextualizing headline growth figures within broader macro-financial frameworks.

Inflation Interaction and Monetary Policy Signals

Inflation dynamics critically shape interpretations of gross domestic product changes. When inflation-adjusted (real) GDP rises steadily, purchasing power remains intact, supporting positive investment sentiment. However, nominal GDP increases without corresponding real growth often reflect price level escalations rather than genuine output gains. Central banks closely monitor these distinctions to calibrate interest rates appropriately; unexpected inflation spikes tend to trigger tightening cycles that can dampen asset valuations across equities and cryptocurrencies alike.

Predictive Models Using Leading Economic Clues

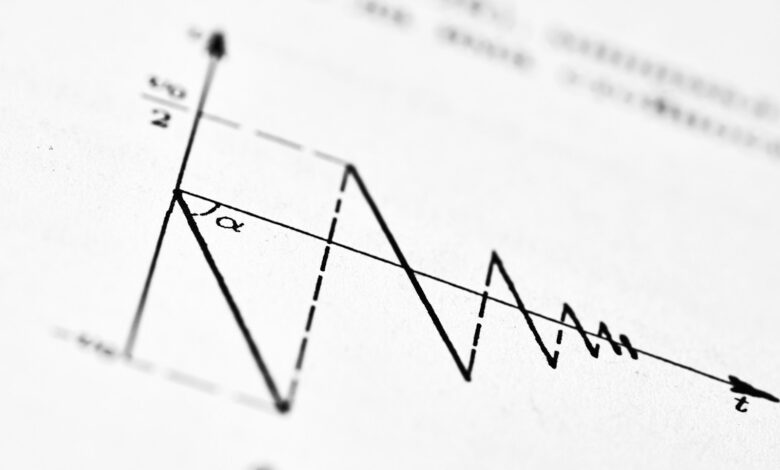

Incorporating forward-looking variables such as yield curve spreads or consumer confidence indices improves forecasting accuracy for forthcoming GDP developments. A flattening or inverted yield curve historically precedes recessions by signaling reduced investor confidence in near-term economic prospects. Similarly, sharp declines in consumer sentiment frequently anticipate contractions in retail sales and service sector activity that weigh on overall production volumes.

Regulatory Shifts Impacting Growth Interpretation

Recent regulatory adjustments–ranging from tax reforms to trade policies–introduce additional layers of complexity when analyzing GDP trends. For example, tariff escalations can suppress export components while stimulating import substitution efforts domestically, temporarily distorting output measurements. Recognizing these influences is essential for differentiating transient fluctuations from enduring growth patterns that justify strategic portfolio reallocations.

Analyzing Unemployment Rate Shifts

Monitoring fluctuations in the unemployment rate provides valuable foresight into forthcoming shifts in inflation trends and overall economic momentum. A rising unemployment figure often signals weakened consumer spending power, which can suppress inflationary pressures despite other growth metrics like GDP showing resilience. Conversely, declining unemployment typically heralds tightening labor markets that drive wage growth, potentially accelerating price levels. For cryptocurrency markets, such shifts influence investor sentiment by altering risk appetites and expectations for monetary policy adjustments.

Leading measures of employment changes frequently precede broader economic contractions or expansions. For instance, during the 2020 global downturn, rapid increases in joblessness correlated with sharp declines in industrial output and service-sector activity. Tracking these labor market variations alongside manufacturing indexes and retail sales offers a comprehensive view of cyclical turning points. Integrating this information enables more precise timing of asset allocation decisions within blockchain-based investment vehicles sensitive to macroeconomic stimuli.

Key Mechanisms Behind Labor Market Impacts

Employment fluctuations affect capital flows through multiple channels: reduced hiring dampens household income, lowering demand for goods and services; persistent joblessness can erode consumer confidence, amplifying deflationary tendencies; central banks may respond by adjusting interest rates to stabilize prices and stimulate growth. Examining historical data reveals correlations between sustained unemployment shifts and subsequent GDP revisions. This relationship underscores the necessity to incorporate labor statistics into predictive models used by quantitative funds managing crypto portfolios exposed to traditional financial cycles.

Case studies from post-2008 recovery periods illustrate how varying regional unemployment rates influenced divergent inflation outcomes across economies. In countries where employment rebounded swiftly, inflation pressures increased sooner, prompting earlier tightening of monetary policies compared to regions with sluggish job market recoveries. Such disparities highlight the importance of granular labor market analysis when forecasting macroeconomic conditions impacting decentralized finance sectors and related token valuations.

Impact of Inflation Reports

The release of inflation metrics directly influences asset valuations, often triggering immediate market adjustments. Investors and traders should closely monitor the Consumer Price Index (CPI) and Producer Price Index (PPI) figures as they provide critical insights into price stability and purchasing power fluctuations. Elevated inflation readings typically prompt central banks to consider tightening monetary policy, which can lead to increased interest rates and heightened volatility across various financial instruments.

Inflation statistics serve as leading measures that interact closely with employment trends, reflecting the balance between wage growth and cost pressures. A detailed examination of these figures alongside labor market reports enhances forecasting accuracy regarding future economic momentum. For instance, a simultaneous rise in inflation and employment levels may signal an overheating economy, prompting strategic portfolio reallocations toward inflation-protected assets or sectors less sensitive to rate hikes.

Interconnection Between Inflation and GDP Growth

Gross Domestic Product (GDP) growth rates often correlate with inflation dynamics; moderate price increases can accompany robust output expansion, whereas stagflation scenarios manifest through stagnating GDP paired with rising consumer costs. Analyzing quarterly GDP releases in conjunction with inflation trends enables a comprehensive understanding of underlying economic health. For example, during periods of rapid GDP growth exceeding potential output, upward pressure on prices tends to intensify, necessitating vigilant adjustment in risk exposure.

Market participants utilize composite frameworks combining inflation data with other macroeconomic indicators such as retail sales and industrial production to gauge cyclical shifts. This multifaceted approach allows for refined assessment of demand-pull versus cost-push inflation components. Case studies from recent years illustrate how unexpected spikes in input prices disrupted supply chains and influenced both fixed income yields and equity valuations worldwide.

- Inflation surges often precede central bank interventions affecting liquidity conditions.

- Employment report releases frequently confirm or contradict inflationary signals, guiding policy expectations.

- Divergences between headline and core inflation figures can reveal transient versus persistent pricing trends.

Cryptocurrency markets respond distinctively to inflation disclosures due to their decentralized nature and limited supply features. While traditional currencies may depreciate under sustained inflationary pressure, certain digital assets are increasingly perceived as hedges against fiat devaluation. Analytical models incorporating real-time transaction volumes and network activity provide nuanced perspectives on how crypto valuations react post-inflation announcements compared to conventional markets.

Strategic decision-making benefits from integrating forward-looking projections derived from leading statistical releases with historical context. Scenario analyses simulating varying inflation trajectories assist institutional investors in stress testing portfolios under divergent monetary policy regimes. Consequently, disciplined attention to the interplay between price indices, employment metrics, and GDP fluctuations forms the foundation for anticipating market behavior following key economic bulletin disclosures.

Understanding Consumer Confidence Data

Consumer confidence metrics serve as leading barometers reflecting household sentiment toward current and future financial conditions. Fluctuations in these measures often precede shifts in GDP growth patterns, signaling potential expansions or contractions within an economy. For investors and analysts tracking cryptocurrency markets, monitoring such sentiment indices provides early warnings about spending behavior alterations that could influence digital asset demand.

The relationship between consumer optimism and inflation expectations is particularly significant. Elevated confidence typically correlates with increased consumption, which can accelerate price pressures and prompt central banks to adjust monetary policies. Tracking these sentiments alongside inflation trends enables a more nuanced interpretation of prospective interest rate moves impacting both traditional and crypto markets.

Technical Insights into Consumer Sentiment’s Role

Empirical studies demonstrate that changes in consumer morale frequently anticipate adjustments in key economic aggregates, including retail sales and personal expenditure levels. For instance, the Conference Board’s Consumer Confidence Index has historically led quarterly GDP reports by one or two months, providing actionable foresight for portfolio allocation strategies. This temporal advantage allows traders to position ahead of broader market reactions grounded in fundamental economic shifts.

Moreover, integrating consumer mood readings with other quantitative signals–such as manufacturing output or labor statistics–enhances predictive accuracy. An example can be seen during periods of rising inflationary pressure when robust confidence suggests sustained demand despite tightening financial conditions. Conversely, declining sentiment amidst stagnant wage growth may forecast slower economic momentum, influencing risk assessment protocols across asset classes.

Incorporating consumer outlook data into comprehensive forecasting frameworks strengthens scenario planning for blockchain-related ventures sensitive to macroeconomic cycles. The interplay between public perception, regulatory developments, and fiscal stimuli shapes capital flows within decentralized finance ecosystems. Consequently, maintaining vigilance on evolving confidence metrics equips market participants with a strategic vantage point for navigating volatility and optimizing investment timing.

Evaluating Manufacturing PMI Signals: Strategic Insights for Market Participants

Prioritize monitoring leading manufacturing Purchasing Managers’ Index readings alongside employment figures to anticipate shifts in industrial output and inflation trends. Recent fluctuations in PMI components–such as new orders contraction versus steady employment growth–suggest nuanced sectoral dynamics that directly influence broader financial conditions.

The interplay between manufacturing activity and wage pressures remains a pivotal metric, with rising input costs foreshadowing potential inflationary spikes. Incorporating real-time capacity utilization rates enhances predictive accuracy, enabling more precise positioning ahead of central bank policy adjustments and supply chain disruptions.

Key Takeaways and Forward-Looking Considerations

- Composite PMI sub-indices: Divergences between production expansion and supplier delivery delays signal evolving bottlenecks, warranting attention for timing investment reallocations.

- Employment trends within manufacturing: Stable or increasing workforce engagement often precedes acceleration in consumer demand, offering early clues to cyclical recovery phases.

- Inflation linkage: Escalating input prices embedded in PMI surveys provide advanced warnings of cost-push inflation, crucial for adjusting risk models sensitive to monetary tightening scenarios.

- Integration with blockchain analytics: Leveraging decentralized supply chain data can augment traditional survey insights, enhancing transparency around raw material availability and pricing volatility.

A comprehensive approach that combines these quantitative signals with macroeconomic frameworks will better equip investors to navigate upcoming volatility linked to manufacturing cycles. As global supply chains adjust to geopolitical tensions and technological innovation accelerates automation, the relevance of accurate production sentiment indicators will only intensify.

The trajectory of industrial activity encoded in PMI metrics serves not merely as a retrospective gauge but as a forward lens into shifts affecting capital allocation, monetary policy calibration, and inflation expectations across markets. Continuous refinement of interpretative models integrating alternative datasets remains imperative for maintaining an informational edge within the complex nexus of economic variables shaping financial ecosystems.