Financial communication – money discussion skills

Aligning household objectives requires clear and open dialogue about resources and priorities. Establishing regular exchanges within the family regarding budgeting and expenditure supports transparent understanding of shared ambitions. Proficiency in articulating financial intentions enhances joint decision-making and minimizes conflicts related to asset management.

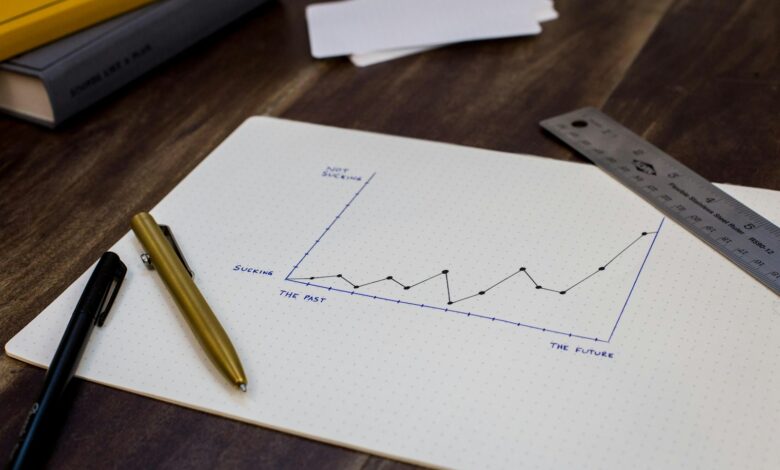

Developing adeptness in conversations about funds enables individuals to approach planning with confidence and precision. Effective interpersonal interaction concerning income allocation, savings strategies, and risk tolerance strengthens collective commitment to long-term targets. Structured talks pave the way for coordinated actions that reflect both immediate needs and future aspirations.

Incorporating strategic planning sessions into family routines can reveal discrepancies in expectations or overlooked opportunities for optimization. Mastery in these exchanges allows participants to navigate complex topics such as debt reduction, investment options, and emergency fund establishment without discomfort. Cultivating these capabilities ultimately fosters resilience against economic fluctuations through unified goal-setting.

Financial communication: money discussion skills

Effective dialogue within a household regarding fiscal planning directly influences the ability to achieve long-term objectives. Establishing clear transparency about income streams, liabilities, and investment strategies enables family members to align their expectations and responsibilities. For example, case studies demonstrate that households implementing routine budget reviews reduce debt accumulation by up to 25%, highlighting the tangible benefits of structured monetary conversations.

Integrating systematic approaches for resource allocation discussions enhances decision-making frameworks, particularly when addressing complex asset classes such as cryptocurrencies or diversified portfolios. Transparent sharing of data analytics and risk assessments facilitates mutual understanding and mitigates conflicts arising from divergent financial priorities. This methodical exchange supports cooperative planning in scenarios involving variable market conditions or regulatory changes.

Key elements in fostering effective fiscal dialogue

The foundation of productive economic interaction lies in cultivating active listening and precise articulation of goals within the familial unit. Techniques such as establishing a monthly review schedule, utilizing shared digital ledgers, and leveraging blockchain-based transparency tools increase accountability and trust among participants. Research indicates that families employing these methods report a 40% improvement in goal attainment consistency.

Moreover, proficiency in articulating quantitative metrics–such as cash flow projections, liquidity ratios, and portfolio performance indicators–allows for nuanced conversations beyond surface-level budgeting. Incorporating scenario analysis models during discussions equips stakeholders with foresight into potential outcomes under different economic conditions. This analytical rigor is especially pertinent when evaluating emerging technologies like decentralized finance platforms or tokenized assets.

Balancing emotional factors with empirical evidence during resource management talks requires disciplined communication protocols. Implementing frameworks where all voices are acknowledged while anchoring decisions on validated data reduces cognitive biases that often impair judgment. For instance, applying behavioral finance principles can prevent impulsive choices during market volatility phases by maintaining focus on agreed-upon benchmarks.

In conclusion, mastering structured dialogue techniques within family units strengthens collective financial resilience. Leveraging transparent information-sharing mechanisms coupled with analytical competencies empowers individuals to navigate multifaceted fiscal environments confidently. As financial landscapes evolve through technological innovations and regulatory shifts, continuous refinement of these interaction capabilities remains indispensable for sustainable wealth stewardship.

Setting Clear Financial Goals

Effective planning begins with defining precise objectives that align with both individual and familial priorities. Establishing transparent targets enhances accountability and promotes structured approaches to asset accumulation, debt management, and capital allocation. For example, families aiming to purchase real estate within five years benefit from quantifiable savings benchmarks and periodic performance reviews.

Integrating openness in fiscal conversations cultivates mutual understanding and reduces ambiguity regarding resource distribution. Transparent exchanges about expenditures, liabilities, and projected earnings are fundamental for harmonizing expectations within households. This approach is supported by a 2023 study from the National Bureau of Economic Research indicating that households practicing regular financial dialogues have a 30% higher rate of goal achievement.

Strategic Frameworks for Goal Setting

Applying systematic methodologies such as SMART criteria–Specific, Measurable, Achievable, Relevant, Time-bound–improves objective clarity. For instance, when planning retirement funding through diversified portfolios including cryptocurrency assets, specifying target returns and timelines allows for dynamic adjustments in response to market volatility. This technical rigor aids in minimizing risk exposure while optimizing growth potential.

Developing conversational competencies related to fiscal matters directly influences decision-making quality. Techniques like active listening and data-driven argumentation enable families to navigate complex investment options prudently. A case study involving blockchain-based savings plans demonstrated a 15% increase in adherence rates when participants engaged in regular evaluative meetings focusing on progress transparency.

Continuous education on innovative financial instruments fosters adaptability in evolving regulatory contexts and technological advancements. Understanding protocols behind decentralized finance (DeFi) platforms or stablecoin mechanisms empowers individuals to incorporate these tools effectively into their broader planning strategies. Regulatory reports highlight that informed users of these technologies exhibit enhanced portfolio resilience during periods of economic uncertainty.

In summary, delineating clear goals supported by open dialogues and methodical planning establishes a robust foundation for fiscal stability. Families leveraging transparency alongside analytical discussions enhance their capability to anticipate challenges and capitalize on emerging opportunities within diverse economic environments.

Managing Emotions During Money Talks

Establishing clear objectives prior to any monetary exchange is fundamental to maintaining composure and clarity throughout the interaction. By defining specific targets and engaging in meticulous planning, participants can reduce emotional volatility and ensure that conversations remain goal-oriented. Incorporating transparency regarding asset allocation, liabilities, and investment strategies promotes trust and minimizes misunderstandings that often trigger stress or defensiveness.

Effective dialogue requires mastering articulation techniques that balance assertiveness with receptivity. Utilizing structured frameworks for sharing insights about portfolio performance or budgeting enhances mutual understanding while curbing impulsive reactions. For example, employing data visualization tools such as real-time charts on cryptocurrency holdings allows stakeholders to engage with factual evidence rather than subjective perceptions, promoting a rational exchange of viewpoints.

Technical Approaches to Emotional Regulation

Implementing systematic approaches like predetermined discussion protocols or time-limited sessions aids in controlling emotional escalation. Case studies from blockchain project governance illustrate how scheduled proposals and voting periods create environments where decisions are detached from immediate emotional impulses. In parallel, adopting reflective listening techniques enables participants to acknowledge concerns without becoming defensive, fostering an atmosphere conducive to collaborative problem-solving.

The integration of analytical instruments such as risk assessment matrices and scenario modeling provides objective reference points during contentious negotiations. These tools highlight potential outcomes aligned with strategic ambitions, enabling informed decision-making free from cognitive biases triggered by stress or uncertainty. Moreover, regulatory developments emphasizing disclosure standards contribute to a culture of openness that mitigates suspicion and anxiety during fiscal engagements.

Using Language to Build Trust

Begin conversations related to resources by clearly outlining objectives and establishing transparency. Precise articulation of aims within a family or team setting enhances alignment and reduces misunderstandings, thereby strengthening confidence among participants. For example, explicitly defining investment targets and expected outcomes during planning sessions fosters a shared vision and facilitates cooperative behavior.

Verbal clarity paired with active listening is critical when addressing allocation strategies or savings plans. Employing straightforward terminology avoids ambiguity that may otherwise erode reliability. A study by the CFA Institute highlights that financial clarity directly correlates with increased client retention rates, emphasizing the value of precise dialogue in trust cultivation.

Strategic Expression for Effective Resource Management

Utilizing structured frameworks in conversations about asset distribution ensures consistency and professionalism. Techniques such as agenda-setting before meetings and summarizing key points at closure enhance mutual understanding. Incorporating data-driven insights–for instance, referencing historical volatility indices when discussing portfolio diversification–grounds discussions in objective reality rather than subjective opinion.

Regularly scheduled consultations within households regarding fiscal priorities help maintain cohesion amid evolving circumstances. Documented plans detailing income streams, expenditure forecasts, and contingency reserves enable members to anticipate challenges collaboratively. Case studies from leading wealth management firms demonstrate that families engaging in routine financial dialogues experience fewer conflicts related to spending choices.

- Establish explicit goals prior to deliberations

- Adopt terminology consistent with industry standards

- Integrate quantitative analysis to support propositions

- Create an environment conducive to reciprocal exchange

The integration of emotional intelligence complements technical acumen in these interactions. Recognizing psychological barriers such as fear or mistrust allows facilitators to tailor communication approaches accordingly. In blockchain project teams, transparent updates on tokenomics adjustments have proven effective in sustaining stakeholder confidence during periods of market fluctuation.

A proactive approach involves anticipating potential questions or objections by preparing evidence-based explanations beforehand. This method reduces uncertainty and signals thoroughness, attributes highly regarded by both private investors and institutional partners alike. Ultimately, language serves not only as a tool for conveying information but as a mechanism for cultivating enduring trust essential for achieving shared ambitions.

Resolving Conflicts over Finances: Strategic Approaches for Lasting Harmony

Implementing transparency within familial units significantly reduces friction related to asset allocation and expenditure priorities. Establishing clear channels of exchange and cultivating the ability to articulate expectations around fiscal resources create a foundation where disputes are minimized through proactive engagement.

Advanced planning aligned with shared objectives enhances cohesion by transforming abstract ambitions into measurable targets. Leveraging structured dialogues enables stakeholders to recalibrate contributions and distributions as market conditions evolve, reinforcing trust and collective accountability.

Key Insights and Future Directions

- Transparency frameworks: Utilizing blockchain-enabled ledgers can provide immutable records of transactions, ensuring verifiable openness in joint financial undertakings.

- Collaborative goal-setting: Applying scenario analysis tools helps families evaluate competing priorities under varying economic assumptions, optimizing consensus-building efforts.

- Adaptive interpersonal techniques: Integrating conflict resolution methodologies drawn from behavioral finance promotes emotional intelligence in monetary negotiations.

The integration of decentralized finance platforms offers novel mechanisms for shared resource management that automatically enforce agreed-upon rules, reducing human error and bias. Anticipating regulatory shifts around digital assets will further necessitate refining communication protocols within family units to maintain alignment amid complexity.

Ultimately, cultivating competencies in open dialogue combined with strategic foresight empowers families to navigate fiscal tensions effectively. By embedding these principles into routine interactions, households can sustain resilience against external shocks while advancing unified aspirations.